2025

Benefits at a Glance

My Medical Benefits

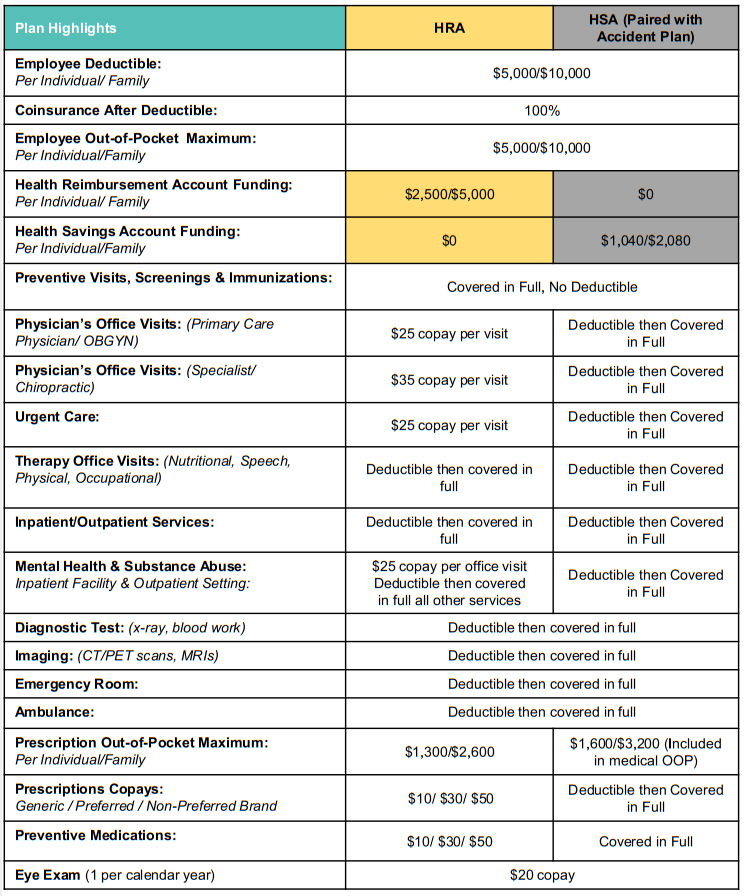

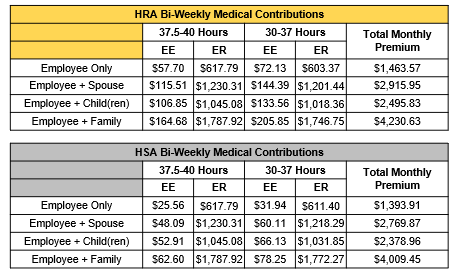

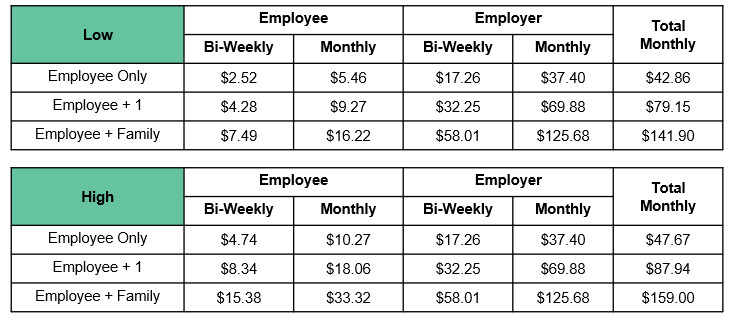

The Agency offers 2 medical plans from CBA Blue. The plans are called HRA and HSA. The HSA is paired with the Accident Plan at no cost to the employee. The Agency contributes a portion to all plans. Medical Contributions are displayed below for the various hourly classes. For more information, please contact Human Resources.

Summary of Benefits & Coverages (SBC)

Contributions

Eligibility

Employees working a minimum of 30 hours per week are eligible to enroll on the first of the month following/coincident with one month of eligible employment. After initial enrollment, this benefit will need to be elected every year during Open Enrollment.

Contact Information

www.cbabluevt.com

(888) 222-9206

CBA Information

CBA Blue LIVE Telemedicine

CBA Blue LIVE provides members with convenient, quality medical consultations via telephone, secure video, and secure email. Health care professionals can evaluate and diagnose many common conditions and recommend treatment plans, including a prescription called into the pharmacy of choice. There are numerous benefits to telemedicine: immediate access to care, no time spent in a waiting room, no transportation time, less time away from work, and privacy assurance.

Pharmacy Information

Discount Programs for Weight Loss

My CancerCARE Benefits

How it Works for Employees:

The CancerCARE Program is an additional benefit, provided by your health plan, that focuses on helping members diagnosed with cancer. We are your cancer advocates and will strive to lead you and your dependents to survivorship!

- Day One Help: We are available to help you from the day of your diagnosis and beyond. You can register for the program at any point in your cancer journey to gain access to our resources and support.

- Personalized Care: Once you are part of the program, a dedicated nurse will be with you every step of the way. This nurse will be available to answer any questions you might have as well as receive ideal treatment.

- National Resources: Through Cancer CARE, you will have access to some of the best doctors, hospitals, and technology nationwide. We will work with your local oncologist to make sure all treatment options are considered, not just local ones.

- Medical Expert Team:Our medical staff has decades of experience treating cancer and we pride ourselves on staying up-to-date with the latest cancer treatments and technology. Each medical staffer has unique cancer expertise and background.

Contact Information

My HealthJoy Benefits

How it Works for Employees:

The CancerCARE Program is an additional benefit, provided by your health plan, that focuses on helping members diagnosed with cancer. We are your cancer advocates and will strive to lead you and your dependents to survivorship!

HealthJoy Makes it Easier to be Healthy and Well.

HealthJoy is the virtual access point for all your healthcare navigation and employee benefits needs. We’re provided free by your employer to help understand and make the most of your benefits. We connect you and your family with the right benefits at the right moment in your care journey, saving you time, money, and frustration.

Help For Your Healthcare Journey.

With 24/7 access to our dedicated healthcare concierge team, visits, and care navigation tools, you never have to walk alone. HealthJoy helps you locate in- network doctors, find extra savings on your prescriptions, and navigate your benefits. Our mobile app and dedicated member support team are always on hand to help make it easier to stay healthy and well.

Contact Information

Chat with us today by logging into the HealthJoy app or call:

(877) 500-3212

My KisX Benefits

How it Works for Employees: Before seeking In-Network Providers through your health plan, just call a KISx Card Nurse regarding your elective procedure. By choosing a KISx Card provider, you will have your deductible waived. Procedure categories include Orthopedics, General Surgery, Colonoscopies, & Most Major Imaging.

- You have been diagnosed and need surgery or major imaging

- You call KISx Card Nurse using the number on the back of your KISx Card

- The KISx Card Nurse will find a participating facility close to your home

- Once a facility has been selected, The KISx Card will reach out to the facility to negotiate the procedure price

- After the procedure price has been determined, we will help you schedule an initial consult with the facility & surgeon

- Once the facility validates the need for surgical intervention, the facility will schedule your surgery with you

- You will receive a voucher in replacement of your insurance card to present the day of the procedure

In most cases, you receive your procedure at no cost!

Locations of participating facilities varies and may require travel. Cost of travel is the members responsibility. Participation in this program is Voluntary.

My Maternity Care Benefits

The Maternity Perks Program provides additional benefits to CBA Blue members

during and after pregnancy. Additional benefits include reimbursement for:

• Car Seats: The Plan provides up to $150 for car seats purchased during pregnancy or up to three (3) months after delivery.

• Maternity Fitness Classes: The Plan provides up to $150 for maternity fitness classes

taken during pregnancy and up to three (3) months after delivery.

• Homemaker Services: The Plan provides up to $225 for homemaker services received

within the first three (3) months after delivery.

• Educational Classes: The Plan provides up to $125 for educational classes taken during pregnancy and up to three (3) months after delivery dealing with topics like childbirth, siblings, parenting, and CPR.

To receive your Maternity Perks Program benefits, the member must file a claim and a paid receipt within six (6) months following delivery. Claim forms are available at your Human Resources office or by visiting our website at www.cbabluevt.com.

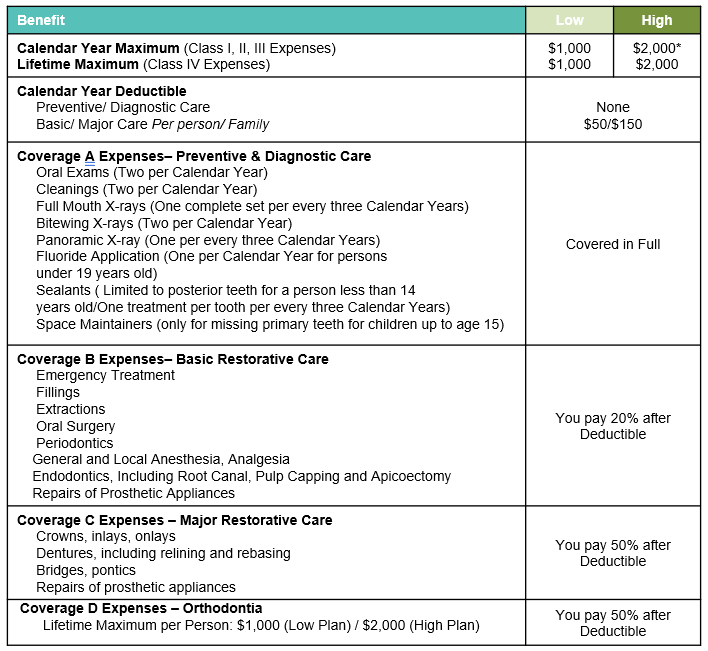

My Dental Benefits

The Agency offers two contributory dental plans. The two plans are a low plan, and a high plan.

Northeast Delta Dental Videos

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

Children are covered to age 26 (coverage expires the last day of birth month).

My Vision Benefits

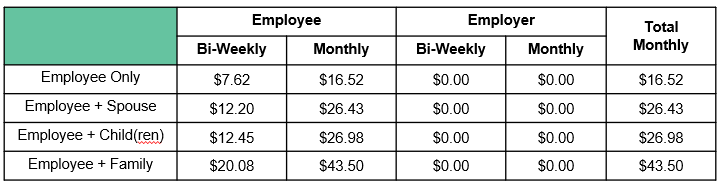

The Agency offers their employees a voluntary vision benefit.

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment

Children are covered to age 26 (coverage expires the last day of birth month).

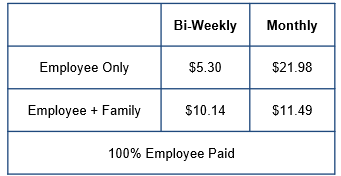

My FSA, DCA, and LPFSA Benefits

Flexible Spending and Dependent Care Accounts

All employees are eligible to enroll for the first of the month following 1 month of employment.

General Medical Reimbursement Account

Employees may set aside up to the annual IRS maximum, on a pre-tax basis, for eligible medical (FSA) expenses or up to $5,000 for dependent care (DCA) expenses.

FSA funds may be used for office visit copays, medical plan deductible, dental plan deductible, vision expenses, and prescription drug copays. As well as any medical/prescription expenses covered under your health plan and any other IRS-eligible expenses. Your plan includes a 75-day grace period that allows you to spend until March 15, 2026, to incur expenses that can be submitted against your 2025 election. There is a 90-day period for submitting previous year FSA expenses. You can submit eligible expenses until March 31st, 2026.

Medical FSA funds are available in full at the start of the plan year.

Dependent Care Account

DCA funds may be used for eligible dependent care expenses. DCA funds are available as they are deducted from pay. DCA funds not used in the plan year in which they were deducted from your pay are forfeited. (There is a 90 day period at the end of the plan year for submitting prior year DCA expenses against the prior DCA plan year.)

You may use these contributions to pay for expenses associated with providing care to children under age 13. Any unused dollars will be forfeited.

Please Note: Over the Counter (OTC) medications (Tylenol, Advil etc.) are not reimbursable through the FSA without a prescription. All claims for OTC medications, with a prescription, must be submitted manually. You will not be able to purchase these items with your card. You may still purchase Over the Counter supplies (Saline contact solution, bandages, etc.) without a prescription and you may use your card for these items.

Limited-Purpose FSA

Employees may pair an LPFSA with their HSA. The LPFSA allows you to make contributions on a pre-tax basis. This allows you to maximize your pre-tax HSA contributions and contribute additional dollars.

The maximum contribution is $3,300. This can be used for dental and vision expenses only.

My HRA and FSA Benefits

Health Reimbursement & Health Savings Accounts

All employees are eligible to enroll for the first of the month following date of hire.

Health Reimbursement Account

HRA funds are funds that may only be spent on the Deductible and Coinsurance of your CCN Medical plan. You will not be reimbursed for pharmacy or office visit co-pays. Claims for reimbursement must be submitted by March 30 of the following calendar year.

The HRA is paired with the HRA plan.

Gold Plan Benefit: CCN provides employees with $2,500/$5,000 (individual/family) on January 1st, 2025 for eligible expenses.

Health Savings Account

An HSA is available with only the HSA Plan, for a list of qualified expenses please visit here. CCN provides employees $40 per paycheck for single coverage and $80 per paycheck for any other tier of coverage. Employees may also make a maximum contribution of $4,150/$8,300 (depending on tier). If you are over the age of 55 you may make an additional contribution of $1,000.

The HSA is owned by the employee. Existing accounts can be transferred to HealthEquity using these instructions.

Choosing an HSA is only the first step. See the power of an HSA in action. We’ll share three strategies for how to spend less on healthcare and invest even more for the future.

Your HSA is like a second 401(k). It’s a powerful invest tool. Find out how to invest your HSA and build the ultimate retirement nest egg.

Take control of your health and grow your money. Discover how to use a Health Savings Account (HSA) to save on healthcare premiums and build long-term health savings.

My FSA/HSA Store Benefits

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

My Life and AD&D Benefits

The Agency offers employees Group Term Life and Accidental Death & Dismemberment coverage. The benefit is 1.5 times your annual earnings plus $10,000 to a maximum of $350,000.

Contributions

This is 100% paid for by Community Care Network.

Eligibility

Class I – Psychiatrists working 24 plus hours per week who are actively at work and have completed the Waiting Period are eligible for insurance.

Class 2 – All other full time employees who regularly work a minimum of 30 hours per week who are actively at work and have completed the Waiting Period are eligible for insurance.

Waiting Period: First of the month following/coinciding with 1 month of continuous employment.

My Short Term Disability Benefits

The Agency offers employees Short Term Disability coverage.

Elimination Period:

14 Calendar Days for Injury / 14 Calendar Days for Accident

Benefit Amount:

60% of Basic Weekly Earnings not to exceed a weekly benefit of $2,500 – see certificate for additional details

Maximum Benefit Period due to Injury or Accident:

- the end of the disability

- the end of the 12th week of Disability for which a benefit is payable

Contributions

This is 100% paid for by Community Care Network.

Eligibility

Class I – Psychiatrists working 24 plus hours per week who are actively at work and have completed the Waiting Period are eligible for insurance.

Class 2 – All full-time Head Start Employees scheduled to support the function of a traditional school year, as determined by the employer.

Class 3 – All other full time employees who regularly work a minimum of 30 hours per week who are actively at work and have completed the Waiting Period are eligible for insurance.

Eligible employees are eligible for this coverage on the first of the month following/coincident with 1 month of employment.

My Long Term Disability Benefits

The Agency offers employees Long Term Disability coverage.

Elimination Period:

The greater of:

- the end of your STD Benefits; or

- 90 days

Benefit Amount:

60% of Basic Monthly Earnings not to exceed a Maximum Monthly Benefit of $11,000 – see certificate for additional details

Contributions

This is 100% paid for by Community Care Network.

Eligibility

Class I – Psychiatrists working 24 plus hours per week who are actively at work and have completed the Waiting Period are eligible for insurance.

Class 2 – All full-time Head Start Employees scheduled to support the function of a traditional school year, as determined by the employer.

Class 3 – All other full time employees who regularly work a minimum of 30 hours per week who are actively at work and have completed the Waiting Period are eligible for insurance.

Eligible employees are eligible for this coverage on the first of the month following/coincident with 1 month of employment.

My Voluntary Life and AD&D Benefits

The Agency offers Voluntary Life and Accidental Death & Dismemberment to employees through Reliance.

Employees can elect a benefit amount for voluntary life and/or voluntary accidental death and dismemberment in $10,000 increments to a maximum of 5x your annual earnings up to $500,000. Any amounts over $150,000 will be subject to Evidence of Insurability.

Employees can elect voluntary life and/or voluntary accidental death and dismemberment on their spouse in $5,000 increments. The benefit must be the lesser of 100% of the Employee’s Voluntary Life benefit or $500,000. Any amounts over $25,000 will be subject to Evidence of Insurability.

Employee can elect voluntary life and/or voluntary accidental death and dismemberment on their child.

- Birth to 14 days: $1,000

- 14 days to 6 months: $1,000

- 6 months to 19 years (26 years if Full-Time Student): $2,000 increments up to $10,000.

Contributions

This is 100% Employee funded.

Eligibility

Employees working a minimum of 30 hours per week are eligible to enroll on the first of the month following/coinciding with one month of eligible employment.

My Voluntary Accident Benefits

The Agency offers Employees Voluntary Accident coverage to employees working a minimum of 30 hours per week.

Voluntary Accident

Group Accident insurance is designed to help covered employees meet the out-of-pocket expenses and extra bills that can follow an accidental injury, whether minor or catastrophic. Indemnity lump sum benefits are paid directly to the employee based on the amount of coverage listed in the schedule of benefits. The accident base plan is guaranteed issue, so no health questions are required.

My Voluntary Critical Illness Benefits

The Agency offers Employees Critical Illness coverage to employees working a minimum of 30 hours per week.

Voluntary Critical Illness

Critical Illness insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness.

Contributions

This is 100% Employee funded.

Eligibility

Employees working a minimum of 30 hours per week are eligible to enroll on the first of the month following/coinciding with one month of eligible employment.

My Norton LifeLock Benefits

Rutland County Mental Health Services wants to help you feel safer over the dark web with Norton LifeLock.

Technology has transformed life as we know it: at home, on the go, and at work. Employees bring personal devices to work. They bring their work devices home.

From their mobile devices, to their computers and connected devices at home or on public wi-fi, to social media and smart technology scattered in their communities around them, their digital lives seem limitless.

Contributions

Eligibility

Employees working a minimum of 30 hours per week are eligible to enroll on the first of the month following/coinciding with one month of eligible employment.

My EAP Benefits

The Agency provides all employees with an Employee Assistance Program (EAP) through ESI Employee Group, an independent, industry-leading company that specializes in total care management. EAP is a voluntary, confidential service that provides professional counseling and referral services designed to help with personal, job or family related problems.

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

In addition to phone-based help, a lot of information can be found online, such as self-assessment tools, interactive databases, health and wellness calculators, webinars and podcasts.

Licensed professionals provide confidential support and guidance related to:

- Family, relationship and parenting issues

- Basic child and elder care needs

- Emotional and stress-related issues

- Conflicts at work or home

- Alcohol and drug dependencies

- Personal development and general wellness issues

- Financial issues

- Legal issues

- They can also refer you for in-person counciling

The Agency’s EAP through ESI Employee Group is a confidential service. No one will know if you use the EAP-not your supervisor, the Agency, or your family members. Any information you provide to Invest EAP is confidential and cannot be shared without your explicit consent.

Contributions

This is 100% paid for by Community Care Network.

Eligibility

All employees and their household members are eligible.

My Retirement Benefits

CCN’s 401(k) plan allows you to invest in your future by saving for your retirement through convenient payroll deductions. This is one of the best ways to save for retirement because both your contributions and earnings are tax-deferred. You can choose the funds in which to invest your savings.

Contributions

Eligibility

Employees may contribute to their own tax-deferred plan through Fidelity. Upon hire, full-time employees (over the age of 21) are eligible to contribute. CCN’s employer match begins after 1 full year of active employment and contributes a dollar for every dollar deferred by the employee, up to the first 2%% of their pay, then 50 cents for every dollar of the next 4%. The maximum employer match is 4% of an employees annual salary, if they contribute 6%.

Once you are eligible you can enroll with Fidelity at www.401k.com

* For employees who are not yet 21 or those who want to save for retirement during their first year of employment, you can enroll in the 403(b) plan. Please use the attached 403(b) enrollment form.

Contact Information

Phone: (800)-343-3548

** Community Care Network does not have a specific adviser for 401(k) or 403(b) services.

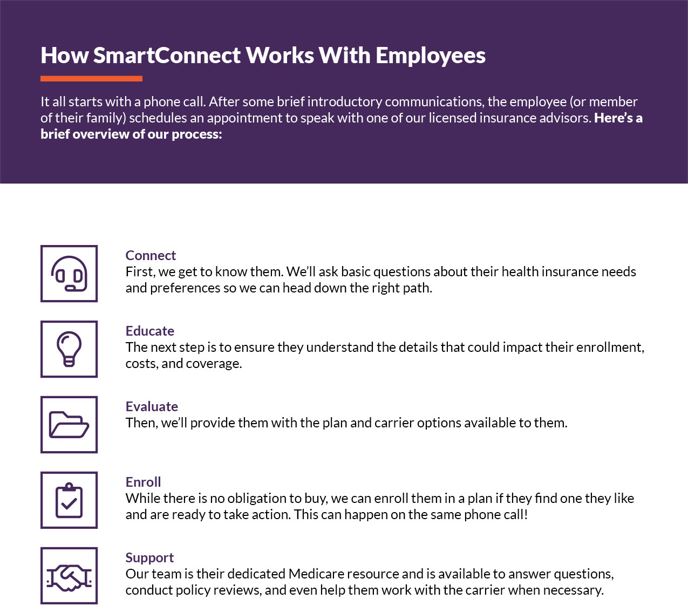

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

http://gps.smartmatch.com/pareto

(855) 248-1648 TTY: 711

Additional Information

My Tuition Assistance Benefits

The Community Care Network tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing Community Care Network’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit: https://gradfin.com/platform/trg/

Contact Information

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

My MemberDeals Discounts

Community Care Network employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!